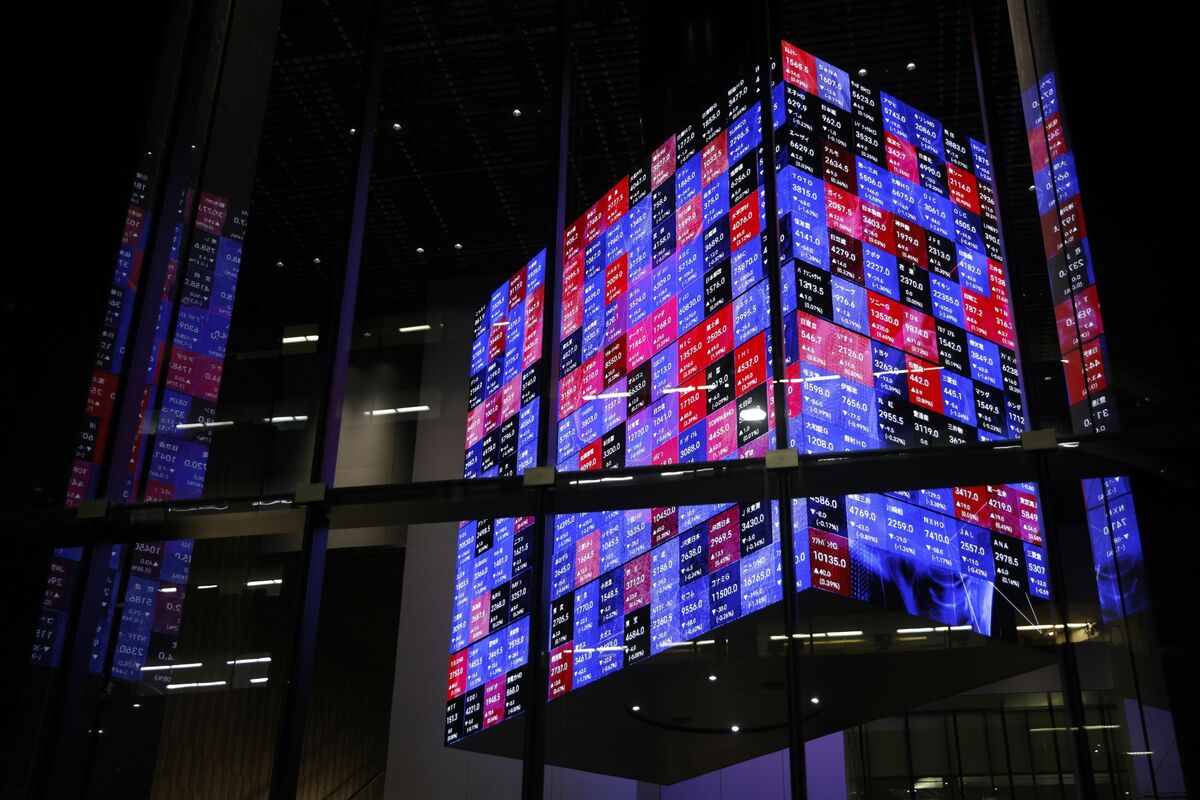

$700M Market Manipulation: Hacker Trading Spree Rocks Crypto Markets

Editor’s Note: A massive $700 million market manipulation scheme involving a sophisticated hacking spree has been uncovered today, sending shockwaves through the cryptocurrency world. This article delves into the details of this unprecedented event, its implications, and what it means for the future of digital assets.

Why This Matters

The recent $700 million market manipulation incident highlights the significant vulnerabilities within the cryptocurrency ecosystem. This brazen attack underscores the urgent need for enhanced security measures, stricter regulations, and improved transparency to protect investors and maintain market integrity. This event impacts not only cryptocurrency investors but also regulators, exchanges, and the broader financial landscape. Understanding the intricacies of this attack is crucial for anyone involved in or interested in the future of digital currencies and blockchain technology. We will explore the key aspects of this manipulation, analyze its impact, and discuss potential preventative measures. Keywords relevant to this topic include: cryptocurrency market manipulation, hacking, blockchain security, digital asset regulation, market volatility, decentralized finance (DeFi), cryptocurrency exchange security.

Key Takeaways

| Point | Description |

|---|---|

| Scale of Manipulation | $700 million in illicit gains. |

| Method of Attack | Sophisticated hacking targeting multiple exchanges and DeFi protocols. |

| Impact on Markets | Significant volatility and price swings across various cryptocurrencies. |

| Regulatory Response | Increased scrutiny and potential for stricter regulations on cryptocurrency exchanges. |

| Investor Concerns | Heightened risk awareness and concerns about security within the crypto space. |

$700M Market Manipulation: A Deep Dive

This unprecedented market manipulation involved a sophisticated hacking operation targeting multiple cryptocurrency exchanges and decentralized finance (DeFi) protocols. The hackers exploited vulnerabilities in security systems, gaining unauthorized access to accounts and executing large-scale trades designed to artificially inflate or deflate the prices of various cryptocurrencies. The resulting volatility caused significant losses for many investors and highlighted critical weaknesses in the current security infrastructure.

Key Aspects of the Attack

- Exploited Vulnerabilities: The hackers likely exploited zero-day vulnerabilities or weaknesses in existing security protocols.

- Coordinated Attacks: The scale and precision of the attacks suggest a highly coordinated and well-resourced operation.

- Money Laundering: The stolen funds are likely being laundered through various channels to obscure their origin.

- Exchange Response: Affected exchanges are cooperating with law enforcement to investigate the attack and potentially recover some of the stolen funds.

Detailed Analysis: Tracing the Hacker's Trail

While the full details of the attack remain under investigation, early reports suggest the hackers used a combination of phishing, social engineering, and potentially even insider access to gain control of multiple accounts across different platforms. The subsequent trades were strategically timed and executed to maximize profit from the artificially induced price swings. A comparison with previous high-profile crypto hacks reveals similarities in methodology, suggesting a possible link to known hacking groups.

Interactive Elements: Understanding DeFi Vulnerabilities

DeFi Protocol Exploits

The attack also targeted several decentralized finance (DeFi) protocols, highlighting the inherent risks associated with this rapidly evolving sector. DeFi's reliance on smart contracts and automated processes makes it particularly vulnerable to exploits if not carefully audited and secured.

Facets:

- Roles: Hackers exploited flaws in the code, protocols, and oracle systems.

- Examples: Specific instances of exploited vulnerabilities within particular DeFi protocols will be detailed as they emerge.

- Risks: Smart contract vulnerabilities, oracle manipulation, and lack of proper security audits.

- Mitigations: Thorough code audits, security best practices, and robust risk management frameworks.

- Impacts: Loss of user funds, market manipulation, and damage to the reputation of affected protocols.

Summary: The DeFi ecosystem's rapid growth must be balanced with equally rapid development of robust security measures to prevent future attacks.

The Role of Centralized Exchanges

Centralized cryptocurrency exchanges, while offering convenience, also present significant targets for hackers. This attack underscores the ongoing need for exchanges to enhance their security measures to protect user funds and maintain market stability.

Further Analysis: The attack raises questions about the adequacy of Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures within the crypto industry. Practical examples of how exchanges can improve security include enhanced multi-factor authentication, cold storage solutions, and regular security audits.

Closing: The reliance on centralized exchanges remains a significant vulnerability in the crypto space; diversification and increased adoption of decentralized alternatives are important considerations for mitigating future risks.

People Also Ask (NLP-Friendly Answers)

Q1: What is this $700M market manipulation incident?

A: It refers to a large-scale hacking and market manipulation scheme where hackers stole $700 million worth of cryptocurrencies by exploiting vulnerabilities in exchanges and DeFi protocols, causing significant price volatility.

Q2: Why is this incident important?

A: It highlights significant security flaws in the cryptocurrency ecosystem, impacting investor confidence, prompting calls for stronger regulation, and demonstrating the need for improved security protocols across exchanges and DeFi platforms.

Q3: How can this affect me as an investor?

A: This incident underscores the risks involved in cryptocurrency investments. It’s crucial to practice due diligence, use secure wallets and exchanges, and diversify your portfolio to minimize potential losses.

Q4: What are the main challenges with preventing these attacks?

A: Challenges include the decentralized nature of crypto, constant evolution of hacking techniques, and the need for widespread adoption of advanced security measures across the entire ecosystem.

Q5: How to get started securing my crypto holdings?

A: Start by using strong, unique passwords, enabling two-factor authentication (2FA) on all your accounts, storing the majority of your assets in secure cold wallets, and staying updated on security best practices.

Practical Tips for Protecting Your Crypto Assets

Introduction: Protecting your cryptocurrency investments requires a multi-layered approach. Following these tips can significantly reduce your risk of becoming a victim of hacking or market manipulation.

Tips:

- Use Strong Passwords and 2FA: Employ strong, unique passwords for all your accounts and always enable two-factor authentication.

- Choose Reputable Exchanges: Only use well-established and reputable cryptocurrency exchanges with a proven track record of security.

- Diversify Your Portfolio: Don't put all your eggs in one basket. Diversify your holdings across multiple cryptocurrencies to minimize risk.

- Secure Your Hardware Wallet: Use a hardware wallet to store the majority of your cryptocurrency offline for enhanced security.

- Stay Informed: Keep up-to-date with the latest security news and best practices within the crypto space.

- Regular Security Audits: If you're running a DeFi project or handling significant crypto funds, conduct regular security audits by reputable firms.

- Be Wary of Phishing: Be cautious of suspicious emails, links, or messages that request your login credentials or private keys.

- Educate Yourself: Understand the risks associated with cryptocurrency investments before committing your funds.

Summary: By diligently implementing these security measures, you can significantly reduce your vulnerability to hacks and market manipulation.

Transition: The scale of this recent attack underscores the urgent need for collective action to enhance the security of the cryptocurrency ecosystem.

Summary (Resumen)

The $700 million market manipulation incident represents a significant challenge to the cryptocurrency industry. This attack highlights the need for stronger security measures, increased regulatory oversight, and greater transparency to protect investors and maintain market integrity.

Closing Message (Mensaje Final)

The events of today serve as a stark reminder of the ever-evolving landscape of cybersecurity within the digital asset space. What steps will you take to safeguard your investments in light of this unprecedented event?

Call to Action (CTA)

Stay informed on the latest developments in the crypto world by subscribing to our newsletter for expert insights and timely updates. Share this article to help others understand the risks and protect themselves from similar attacks.

(Hreflang tags would be added here, specifying language variations of the article)